Unemployed people can reduce their debt burden by consolidating their debts. Important to remember that debt consolidation requires income from a different source. This article will provide information about debt consolidation for those who are not employed. You'll also learn about interest rates, and what savings you can expect by avoiding bankruptcy.

Unemployment

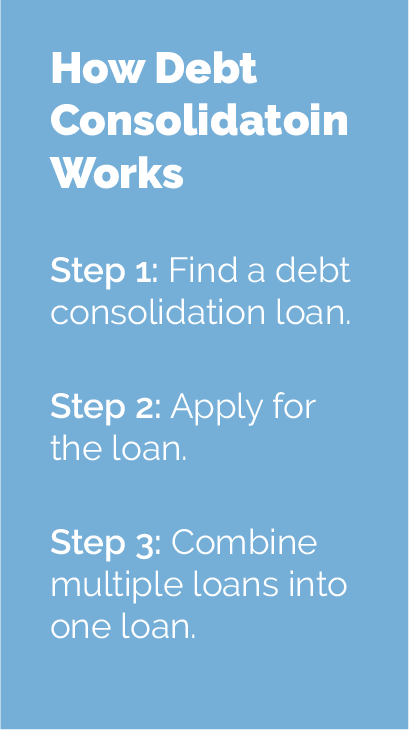

You might be interested in a debt consolidation loan even if you're unemployed. It is possible consolidate your debt and not pay high interest rates. A professional will often negotiate on your behalf with creditors and help you eliminate some of your debt. In addition to eliminating your interest, this method can also help you get your accounts closed.

For unemployed individuals, debt consolidation is a great option because it will result in a lower monthly payment and a lower blended interest rate. In addition, a debt consolidation will simplify your payment process and will eliminate late fees and other fees. It can even pay off if you are able to manage your debt consolidation payments while still working.

Alternatives to debt consolidation

If you are in the middle of an overdraft, it's important to find a job first before looking for debt consolidation alternatives. Depending on your situation, consolidation can be done quickly or it could take months. A job search can be a difficult process for many people. However, it can be extremely helpful for temporary unemployment.

Consolidating your debt will lower your interest rate and simplify your payments. However, it does not guarantee that the debt won't come back. You may not always be able to find the lowest interest rate loan. It will depend on what interest rate you are able to get, how high your credit score is, and how much debt you have.

Personal loans to consolidate debt are subject to high interest rates

The interest rate is important to know before you apply for debt consolidation loans. Some lenders charge high interest rates. However, fees or penalties are typically minimal. In certain cases, you might be able to obtain a lower rate simply by paying your loan off in full within a few month. It is important to check if the lender will charge you origination fees or prepayment penalties.

A personal loan for debt consolidation may help you to reduce the number bills you have. This is a convenient way to manage your finances with just one monthly payment. You should carefully consider the interest rate and repayment schedule before applying for a debt consolidation loan.

Filing for bankruptcy can save you money

Bankruptcy can offer a lifeline for the disabled, those with low incomes, and the unemployed. Insufficient income can lead to bills piling up and going unpaid. Bankruptcy can relieve you from this pressure and allow you to concentrate on your future.

You may be eligible for Chapter 7 bankruptcy depending on your financial situation. This is usually possible within a few months after losing your job. This type of bankruptcy will require you to repay your creditors in monthly installments for three to five years. After filing a Chapter 7, you will retain most of your property, but you must have enough income each month to pay your creditors. You can also choose to repay Chapter 13 debts if your income comes from other sources.

Managing money after debt consolidation

Manage your money when you're not working can be daunting. Many lenders won't lend money to someone without a steady source of income. Credit counseling agencies offer debt consolidation services. This program consolidates all your bills into one monthly payment. Your creditors will also likely lower interest charges.

But you need to be cautious when considering this option. You might not want to consolidate debt if the interest rate is higher than your current debt. In addition, debt consolidation loans come with high fees. Credit card companies may charge balance transfers at 3% to 44% while others could charge up to 55%. These fees will offset any interest savings.

FAQ

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. Our world is characterized by tight budgets and difficult decisions about how to spend it.

Why then do we keep putting off saving money. Is there nothing better to spend our time and energy on?

Yes and no. Yes because most people feel guilty about saving money. Yes, but the more you make, the more you can invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

To become financially successful, you need to learn to control your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because your financial management skills are not up to par.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting refers to the practice of setting aside a portion each month for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

How can a beginner earn passive income?

Learn the basics and how to create value yourself. Then, find ways to make money with that value.

You may even have a few ideas already. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

Find a job that suits your skills and interests to make money online.

You can create websites or apps that you love, and generate revenue while sleeping.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever your focus, choose something you are passionate about. It will be a long-lasting commitment.

Once you've found a product or service you'd enjoy helping others buy, you'll need to figure out how to monetize it.

There are two main ways to go about this. You could charge a flat rate (like a freelancer), or per project (like an agencies).

In both cases, once you have set your rates you need to make them known. It can be shared on social media or by emailing your contacts, posting flyers, and many other things.

These are three ways to improve your chances of success in marketing your business.

-

Be a professional in all aspects of marketing. You never know who could be reading and evaluating your content.

-

Know what you are talking about. Before you start to talk about your topic, make sure that you have a thorough understanding of the subject. A fake expert is not a good idea.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. If someone asks for a recommendation, send it directly to them.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn and keep growing as a marketer to stay relevant.

How can rich people earn passive income?

There are two ways you can make money online. One way is to produce great products (or services) for which people love and pay. This is what we call "earning money".

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's say you own an app company. Your job is to develop apps. But instead of selling them directly to users, you decide to give them away for free. That's a great business model because now you don't depend on paying users. Instead, you rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how most successful internet entrepreneurs earn money today. Instead of making money, they are focused on providing value to others.

What are the most profitable side hustles in 2022?

To create value for another person is the best way to make today's money. If you do it well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. You sucked your mommy’s breast milk as a baby and she gave life to you. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. You'll actually get more if you give more.

Value creation is an important force that every person uses every day without knowing it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

Today, Earth is home for nearly 7 million people. Each person is creating an amazing amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. This is a lot more than what you earn working full-time.

Let's imagine you wanted to make that number double. Let's say you found 20 ways to add $200 to someone's life per month. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day there are millions of opportunities for creating value. This includes selling information, products and services.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. The real goal is to help other people achieve their goals.

To get ahead, you must create value. My free guide, How To Create Value and Get Paid For It, will help you get started.

How to create a passive income stream

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. This requires you to be able connect with people and make sales to them.

You must then figure out how you can convert leads into customers. You must also master customer service to retain satisfied clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

To become a millionaire takes hard work. A billionaire requires even more work. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then you must become a millionaire. Finally, you can become a multi-billionaire. The same applies to becoming a millionaire.

How does one become billionaire? It all starts with becoming a millionaire. All you need to do to achieve this is to start making money.

You have to get going before you can start earning money. Let's discuss how to get started.

Which side hustles have the highest potential to be profitable?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles provide extra income for fun activities and bills.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

The best side hustles make sense for you and fit well within your lifestyle. If you love working out, consider starting a fitness business. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles can be found anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

Why not start your own graphic design company? Perhaps you're an experienced writer so why not go ghostwriting?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. When the opportunity presents itself, be prepared to jump in and seize it.

Remember, side hustles aren't just about making money. Side hustles can be about creating wealth or freedom.

With so many options to make money, there is no reason to stop starting one.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

How to make money at home

There's always room to improve, no matter how much you make online. But even the most successful entrepreneurs struggle to grow their businesses and increase profits.

The problem is that starting a business can make it easy to become stuck in a rut. To focus solely on making money, rather than growing your company. It could lead to you spending more time on marketing and less on product development. Or you may neglect customer service altogether.

It's important to regularly evaluate your progress and determine if you're improving or maintaining the status-quo. These five steps can help increase your income.

-

Increase Your Productivity

Productivity is more than just the output. You must also be efficient at completing tasks. Find out what parts of your job take the most effort and are energy-consuming, and then delegate these tasks to another person.

Virtual assistants can be employed to help you manage customer support, social media management, and email management.

You could also assign a team member to create blog posts and another to manage your lead-generation campaigns. If you are delegating, make sure to choose people who will help your achieve your goals more quickly and better.

-

Marketing should be a secondary focus.

Marketing doesn’t always have to mean spending a lot. Some of the best marketers aren't paid employees at all. They're self-employed consultants who earn commissions based on the value of their services.

Instead of advertising products on television, radio and in print ads, consider affiliate programs that allow you to promote the goods and services of other businesses. You don't have to buy the expensive inventory to generate sales.

-

For the impossible, hire an expert

You can also hire freelancers for expertise in specific areas. Hire a freelance designer to create graphics on your site if you aren’t an expert in graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be time-consuming when you're a contractor. It can be particularly tedious if you have multiple customers who want different things.

Apps such as Xero, FreshBooks, and FreshBooks let you invoice customers quickly and efficiently. You can enter all your client information once and send them invoices directly through the app.

-

Sell More Products With Affiliate Programs

Affiliate programs are great because you can sell products without stock. It's also easy to ship products. You only need to create a link between your site and the vendor's website. You will then receive a commission every time someone purchases something from the vendor. Affiliate programs will help you to make more money and build a brand. It doesn't matter how good your content or services are, as long as they help you attract people.