You may be able to negotiate with your creditor, if you are having difficulty paying off your credit card debt. You can negotiate a reduction in the balance or interest rate. There are other options, such as a hardship agreement or workout agreement. This will lower your total amount owed and make it easier to pay the balance off faster.

Generally, when you begin negotiating with your creditor, you will start with a phone call. You will need to describe your situation during the phone conversation. Explain your current financial position and ask for information on the company's hardship plans. Keep a record of every conversation. You can create a written record to help you make a legal agreement.

Once you have all of your information, it is possible to make a claim for lower payments. Additionally, it is important to understand how the settlement will impact your credit score. Debt settlement is considered to be a negative mark on your credit report, and it can hurt your future borrowing chances.

Your creditor will be impressed that you are willing and able to come up with a plan to get your monthly payments on track. They want you to be a loyal customer and will do everything to get you to pay on time. You may not be able to settle your account for less that the full amount. They may even suspend your account while the hardship plan is being completed.

Before calling your creditor, make sure you look at the amount you owe and evaluate the options you have. One option is to offer a lump sum payment. Talk to a nonprofit credit counseling organization. These agencies can help you get sound advice on managing your money.

A clear understanding of your current financial status will allow you to negotiate with your creditors more effectively. A better financial situation can include a low ratio of debt to income, low credit utilization, and no outstanding delinquencies.

You can expect lengthy conversations, sometimes lasting for several months, as you try to negotiate your credit cards debt. You may be asked for your contact information and a copy your credit report depending on how you are relating to the creditor. Make sure you keep a detailed record of your conversations, so you can easily refer to them later.

After learning about your options, you should contact the creditor’s Customer Service department. They will be able to connect you with the correct department and provide all the information you need.

Next, you should write down all of the details you can think of, such as the monthly balance, the interest rates, and the payments. It is important to remain patient and persistent during negotiation. By taking the time to prepare for the negotiation, you will be more likely to reach an agreement.

Negotiating a repayment schedule is the last step of the credit card debt negotiation process. This could be a reduced interest rate or a shorter minimum payment. You may be able to defer payments for a limited time with some creditors.

FAQ

What are the top side hustles that will make you money in 2022

To create value for another person is the best way to make today's money. If you do this well, the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. When you were a baby, you sucked your mommy's breast milk and she gave you life. You made your life easier by learning to walk.

You will always make more if your efforts are to be a positive influence on those around you. In fact, the more you give, the more you'll receive.

Without even realizing it, value creation is a powerful force everyone uses every day. It doesn't matter if you're cooking dinner or driving your kids to school.

In actuality, Earth is home to nearly 7 billion people right now. Each person creates an incredible amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day there are millions of opportunities for creating value. Selling products, services and ideas is one example.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. The real goal is to help other people achieve their goals.

To get ahead, you must create value. You can get my free guide, "How to Create Value and Get Paid" here.

What is personal finance?

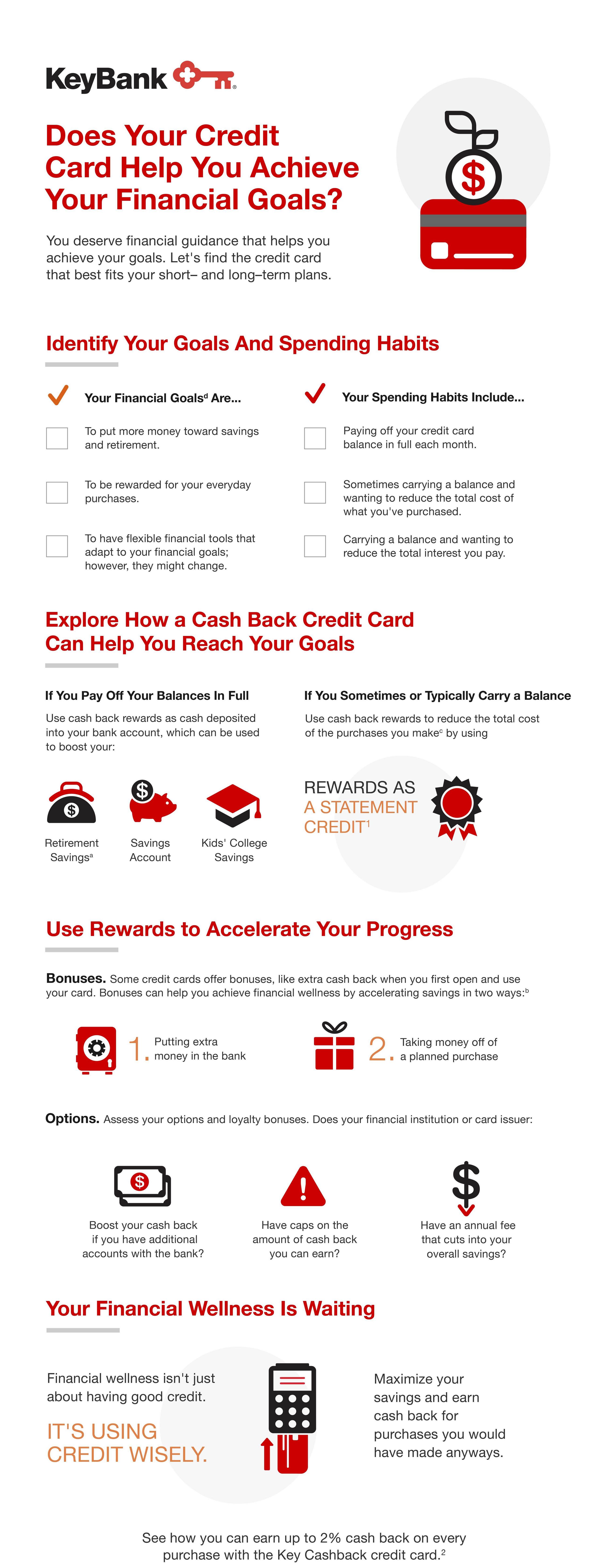

Personal finance is the art of managing your own finances to help you achieve your financial goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You won't have to worry about paying rent, utilities or other bills each month.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finances? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today, people use their smartphones to track budgets, compare prices, and build wealth. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

When you master personal finance, you'll be able to take advantage of that time.

What is the difference between passive and active income?

Passive income refers to making money while not working. Active income requires work and effort.

You create value for another person and earn active income. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. They choose to make passive income and invest their time and energy.

Passive income doesn't last forever, which is the problem. If you wait too long to generate passive income, you might run out of money.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, Start now. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Side hustles that are active include tutoring, dog walking, and selling products on eBay.

Side hustles that are right for you fit in your daily life. You might consider starting your own fitness business if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

Side hustles can be found everywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Maybe you're a writer and want to become a ghostwriter.

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Remember, side hustles aren't just about making money. Side hustles are about creating wealth and freedom.

There are many ways to make money today so there's no reason not to start one.

What is the easiest passive source of income?

There are many online ways to make money. Many of these methods require more work and time than you might be able to spare. How can you make it easy for yourself to make extra money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. That passion can be monetized.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is known as affiliate marketing and you can find many resources to help get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You might also think about starting a blog to earn passive income. It's important to choose a topic you are passionate about. You can also make your site monetizable by creating ebooks, courses and videos.

There are many online ways to make money, but the easiest are often the best. It is important to focus on creating websites and blogs that provide valuable information if your goal is to make money online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

What is the best way for a side business to make money?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You must also find a way of establishing yourself as an authority in any niche that you choose. That means building a reputation online as well as offline.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

You will see two main side hustles if you pay attention. The first involves selling products or services directly to customers. The second involves consulting services.

There are pros and cons to each approach. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting is a great way to expand your business, without worrying about shipping or providing services. But it takes longer to establish yourself as an expert in your field.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. But it will pay off big in the long term.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money online

Making money online is very different today from 10 years ago. You have to change the way you invest your money. While there are many methods to generate passive income, most require significant upfront investment. Some methods are more difficult than others. There are a few things to consider before you invest your hard-earned money into any online business.

-

Find out what kind of investor you are. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. Affiliate marketing is a better option if you are more interested in long-term earnings potential.

-

Do your research. Research is essential before you make any commitment to any program. You should read reviews, testimonials, as well as past performance records. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Do not rush to tackle a huge project. Instead, begin by building something basic first. This will allow you to learn the ropes and help you decide if this business is for you. You can expand your efforts to larger projects once you feel confident.

-

Get started now! It's never too early to begin making money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All you need to get started is an idea and some hard work. Get started today and get involved!